What is a Land Loan?

A land loan, also known as a plot or lot loan, is a financial option allowing individuals to purchase a piece of land using credit. This type of loan is suitable for those who intend to acquire land without immediate construction plans. It’s important to note that land loans differ from home loans or construction loans. It can be used for both residential and business purposes.

Types of Land Loans

Land loans can be categorized based on the level of land development. Each type of land loan necessitates distinct preparations to convince lenders to provide financing. Let’s explore the different types:

- LOAN FOR UNDEVELOPED LAND (RAW LAND LOAN)

- Undeveloped land refers to properties without road access, water supply, electricity, or sewer lines, rendering the land unsuitable for immediate construction. While raw land is the most economical option for purchase, it also requires higher down payments and interest rates to secure a loan. The Federal Deposit Insurance Corp. (FDIC) sets a minimum down payment of 35% for undeveloped land. Additionally, to obtain a raw land loan, you’ll need a well-structured and detailed plan for the land’s development to convince lenders that it represents a calculated risk.

- LOAN FOR SEMI-DEVELOPED LAND (UNIMPROVED LAND LOAN)

- Semi-developed or unimproved land typically possesses some basic infrastructure, although it may need more amenities such as phone boxes, natural gas, or electric meters. Financing a loan for unimproved land is less risky than undeveloped land but still requires a rigorous process. The FDIC’s minimum down payment standard for unimproved land is 25%.

- LOAN FOR DEVELOPED LAND (IMPROVED LAND LOAN)

- Developed lands, often called lots, come with access roads and all the necessary utilities for residential construction. Although improved lots are more expensive, they tend to have comparatively lower land loan interest rates. Lenders are also more inclined to finance this type of loan, with the FDIC setting the minimum down payment for improved land loans at 15%.

Advantages of Taking a Land Loan

Land loans offer several advantages for individuals who need more time to build on their purchased land. These advantages include:

- Flexibility: Land loans provide the flexibility to secure land for its potential, such as in areas with upcoming business opportunities or future development. You can hold the land until the timing is right for your construction project.

- “Blank Canvas”: Acquiring land before any construction allows you to start with a “blank canvas.” You can envision and create your dream home or commercial space according to your preferences and needs.

- Transition to Construction Loan: When you’re ready to build, your land loan can be seamlessly integrated with a construction loan to finance the land purchase and construction costs. Ultimately, this can transform your land loan into a standard mortgage when you’re ready to move in.

Disadvantages of Taking a Land Loan

Despite the advantages, land loans come with certain disadvantages, mainly due to the higher risks involved:

- Limited Lender Options: Lenders for land loans can be limited in number due to the inherent risks, which may limit your choices when selecting a lender.

- Stricter Qualifications: To secure a land loan, you must meet more stringent qualifications than a standard mortgage.

- Higher Down Payments and Interest Rates: Land loans have higher down payment and interest rates than traditional mortgages. These additional costs are a result of the higher risks faced by lenders.

To mitigate these disadvantages, having a well-defined construction plan, including a set timeline and cost estimates, can increase your loan approval chances, is essential.

Land Loan vs. Other Land-Buying Options

If you encounter difficulties meeting land loan qualifications, alternative methods exist to finance your land purchase. Some options cater to home-building purposes, while others are designed for commercial space.

- SELLER-FINANCING

- Seller financing is where the seller acts as your lender in a land contract. This arrangement can be more flexible and suitable for those who may not meet traditional bank loan requirements. It’s essential, however, to engage an attorney to review the land contract to ensure clarity and prevent potential gray areas or loopholes.

- HOME EQUITY LOAN

- Another method for purchasing land is through a home equity loan, where you receive a lower interest rate against your home’s equity. It’s important to note that defaulting on this type of loan could lead to the risk of losing your home.

- HOME EQUITY LINES OF CREDIT

- Home Equity Lines of Credit (HELOCs) provide a flexible way to access funds over a specified timeframe using your home’s equity. You can use a HELOC as a down payment for a land loan and repay the HELOC amount and interest.

- USDA LOAN

- The USDA offers a land and construction loan designed for low to moderate-income families planning to build a home in a qualified rural area. This option can particularly benefit those seeking a more affordable land and home construction path.

- SBA LOAN

- Small Business Administration (SBA) loans are available to assist small business owners in financing raw land and construction costs for commercial buildings. The SBA 504 loan program provides fixed-rate financing with a 10% down payment, 40% loan financing through the Certified Development Loan, and 50% provided by a bank or credit union.

- PERSONAL LOAN

- A personal loan can also finance your land purchase. While this approach can offer flexibility, it can have higher interest rates. You may also need to compare its shorter repayment periods with the rest.

Looking for a Land Loan?

Securing a land loan can be more challenging than obtaining a standard mortgage. However, you can increase your chances of approval with proper preparation. A credit union consultant specializing in land financing can provide significant assistance in navigating the process and ensuring your specific needs are met when purchasing land. Explore your options and receive expert guidance by scheduling an appointment with us today.

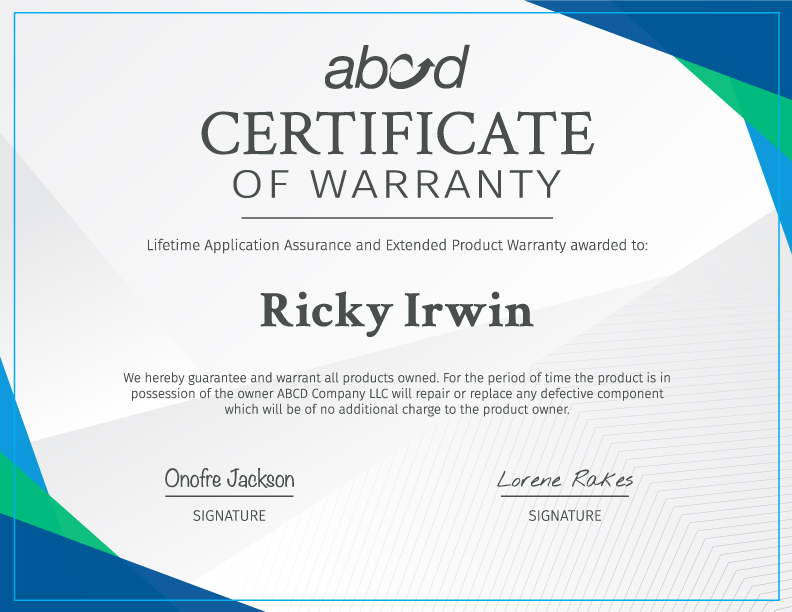

Product Warranty Certificate

Product Warranty Certificate