Ever found yourself at a dinner party, trying to explain **how much is Medicare Part B**? It’s not exactly cocktail conversation. Yet here we are, about to break it down. Believe me, it’s actually way more captivating than you’d initially assume.

The cost of Medicare Part B seems straightforward at first glance: $174.70 for 2024, up from last year. But that’s just the tip of the iceberg.

Why does this matter? Because your health isn’t a static thing; it changes as often as your Netflix password (thanks to family members who can never seem to remember it). So understanding these costs is crucial—like knowing whether you need that extra streaming service or if you’re just going to rewatch “The Office” again.

Sure, talking premiums and income adjustments might not get you invited back next Saturday night. But hey, being informed has its own perks—like making better decisions for your future self (who will definitely thank you).

Understanding the Cost of Medicare Part B

Ever wondered how that monthly premium for Medicare Part B gets decided? Well, it’s not just pulled out of a hat. Let’s break it down.

The Impact of Income on Premiums

The amount of money you make influences the premiums you’re charged. If you’re rolling in dough (or even if you’re just doing okay), expect to shell out a bit more for your premiums. It’s all about those income-related monthly adjustments.

How Social Security Determines Your Premium

Social Security isn’t just about retirement checks; they also play referee with your Medicare Part B premiums based on your earnings report card from two years back.

Navigating Medicare Part B costs? Your income from 2 years ago decides your premium. More dough, higher Rates. #MedicareBasics #HealthcareCostsClick to Tweet

Exploring What Medicare Part B Covers

Types of services Covered by Part B

You’ve got questions about what Medicare Part B covers, right? Let’s break it down. Think of Part B as your go-to for two big categories: medically necessary services and preventive services.

- Medically Necessary Services: These include doctor visits, outpatient care, and some home Health services.

- Preventive Services: These encompass flu shots, screenings, and more – usually at no cost if you’re with a provider who accepts assignment.

Determining if a Service is Covered

Coverage under Medicare isn’t just thrown together. It leans on three pillars: federal/state laws, national decisions by Medicare itself, and local coverage decisions where you live. It’s a pretty neat system.

Navigating Medicare Part B? It covers essentials like doctor visits and flu shots, tailored by laws and local decisions. Dive into how it works for you.Click to Tweet

Cost Adjustments in Medicare Part B

So, you noticed your Medicare Part B premium took a hike or maybe it did the opposite and decided to take a chill pill. What gives? Well, it’s all about the greenbacks – yes, your income.

Changes in Income and Their Effect on Premiums

If last year was kind to you financially (think: more cash flowing in), expect Uncle Sam to ask for a bit more for your Medicare Part B premium. But hey, if things went south and your income dipped, there’s hope yet that your premiums could see some relief too.

Disagreeing with Premium Decisions

Felt like those numbers didn’t add up? You’ve got rights. If you disagree with how they calculated your premium based on income changes, don’t just stew over it – appeal. Yes, you can totally do that online; quick and painless.

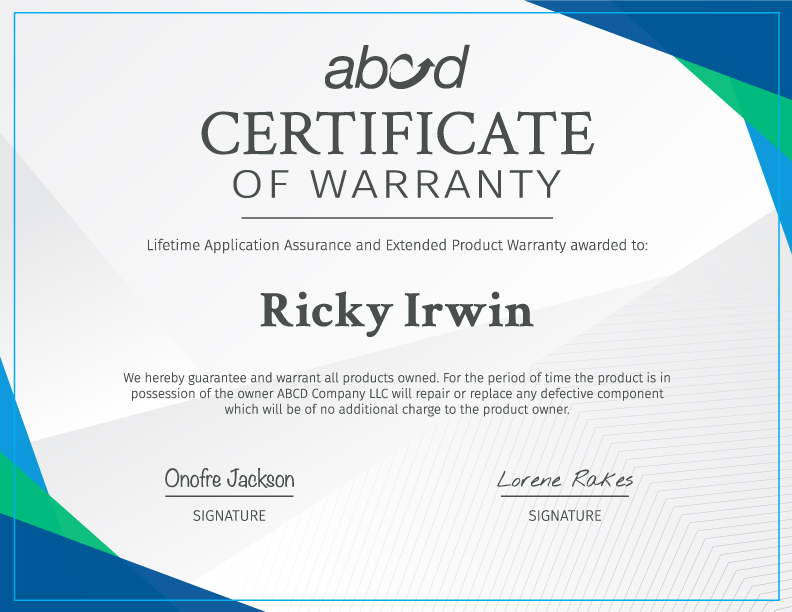

Product Warranty Certificate

Product Warranty Certificate